Digitize Document Paperwork With Digital Stamping

With Leegality Document Infrastructure you get eSign, eStamp, Document Assembly, Document Enforceability, Automation, Security and MORE, all under one roof

Request Free Demo

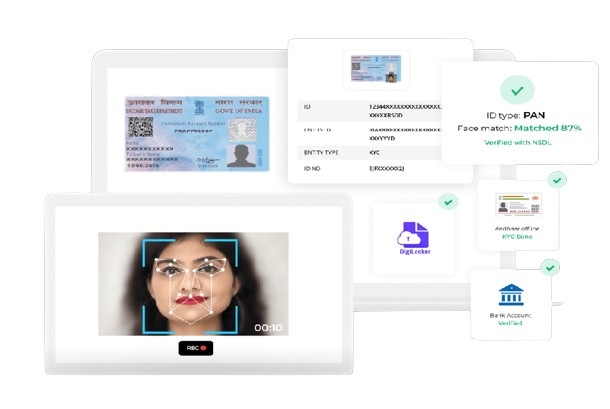

In person verification (Video, Selfie)

Id Card OCR Parsing with Verification

Built-in Digilocker Integration

Business Background Verification

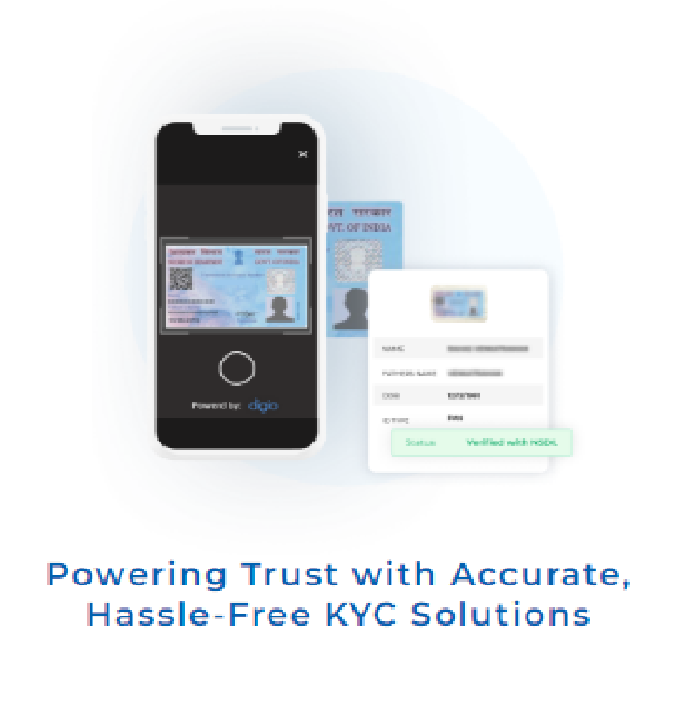

IDENTITY ESTABLISHMENT

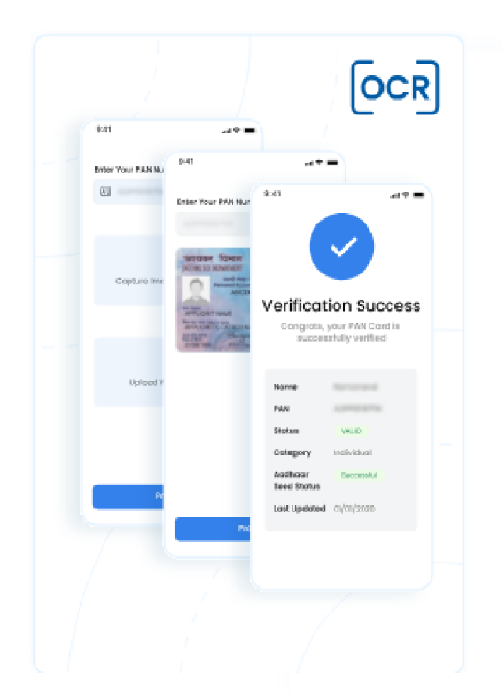

Identify and Document Verification using OCR and Data Parsing

Digio ID analysis and verification APIs can be used for extracting data and user image through Image-level detection and Optical Character Recognition (OCR) technologies

The frontrunner OCR in indian markets

Recognistion of all identity cards of Indian origin in image/pdf form (Aadhaar, Voter ID, DL, Passport, more)

Validation and verification from central database

Text, Image and signature detection and real time check with eKYC database ie. CVLKRA, CERSAL, CAMSKRA, NDML etc

Benchmarked for spot on accuracy

Out OCR modal boasts an impressive accuracy rate of 96% based on a sample size 5M+ ID cards

Parsing Powerful data extraction from key documents

Customized documents capture and data extraction from PDF, Word etc with quick and simple no-code setup

IDENTITY ESTABLISHMENT

Digilocker Integrations

Ensure access to all digitally stored documents are approved under Indian law

Access Legally Binding Electronic IDs for Verification

e-document for Digilocker are approved under Indian Laws, acceptable as per PMLA guidelines and KYC circular RBI, SEBI, IRDAI, or any other central regulators

Single Point Authentication for Enhanced Efficiency

Access multiple identity documents with just a single point of authentication stramlines the process of document retrieval, saving time and resources

IDENTITY ESTABLISHMENT

BUSINESS KYC

Gain a complet and detailed perspective of non-individual entitles

Comprehensive Business Verification and Validation

Ensure the authenticity of GSTIN, PAN, CIN, Director DIN, MSME/Udyog Aadhaar, and FSSAI

Business Risk Assessment

Identify potential business risks by monitoring factors like MCA Defaults, Indirect Tax compliance, and more

ENHANCED DUE DILIGENCE

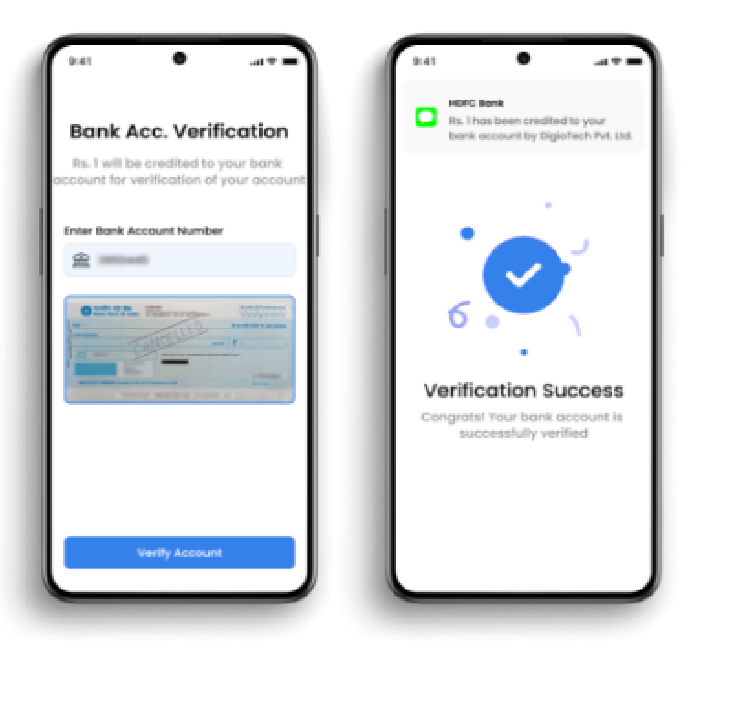

Seamless Bank Account Verification

Ensure consistency and accuracy of the bank account information and detect discrepancies or red flags that may lead to fraqudlent activities

Support All Banks A/c Verification Modes and Higher Uptime

Penny Drop standard Re. 1, Custom, Penniless and Reverse via UPI, bulk bank a/c verification. Integration with multiple sponsor banks for higher uptime of services.

Integrity Checks

We ensure data integrity by conducting fuzzy checks between the name as per KYC records and the name as per bank records.

Streamline Customer Onboarding

Make the onboarding process hassle-free using our pluggable KYC solutions.

In-built Regulatory Flows

100 % conformance to the latest guidelines from RBI, SEBI and other regulators

Set Intelligent Auto-approval Rules

Set auto-approve rules or manually approve, re-request KYC and get real time events using webhooks

Powerful Web and Mobile SDKs

Integrate your web and mobile-based applications seamlessly with simple to use SDKs